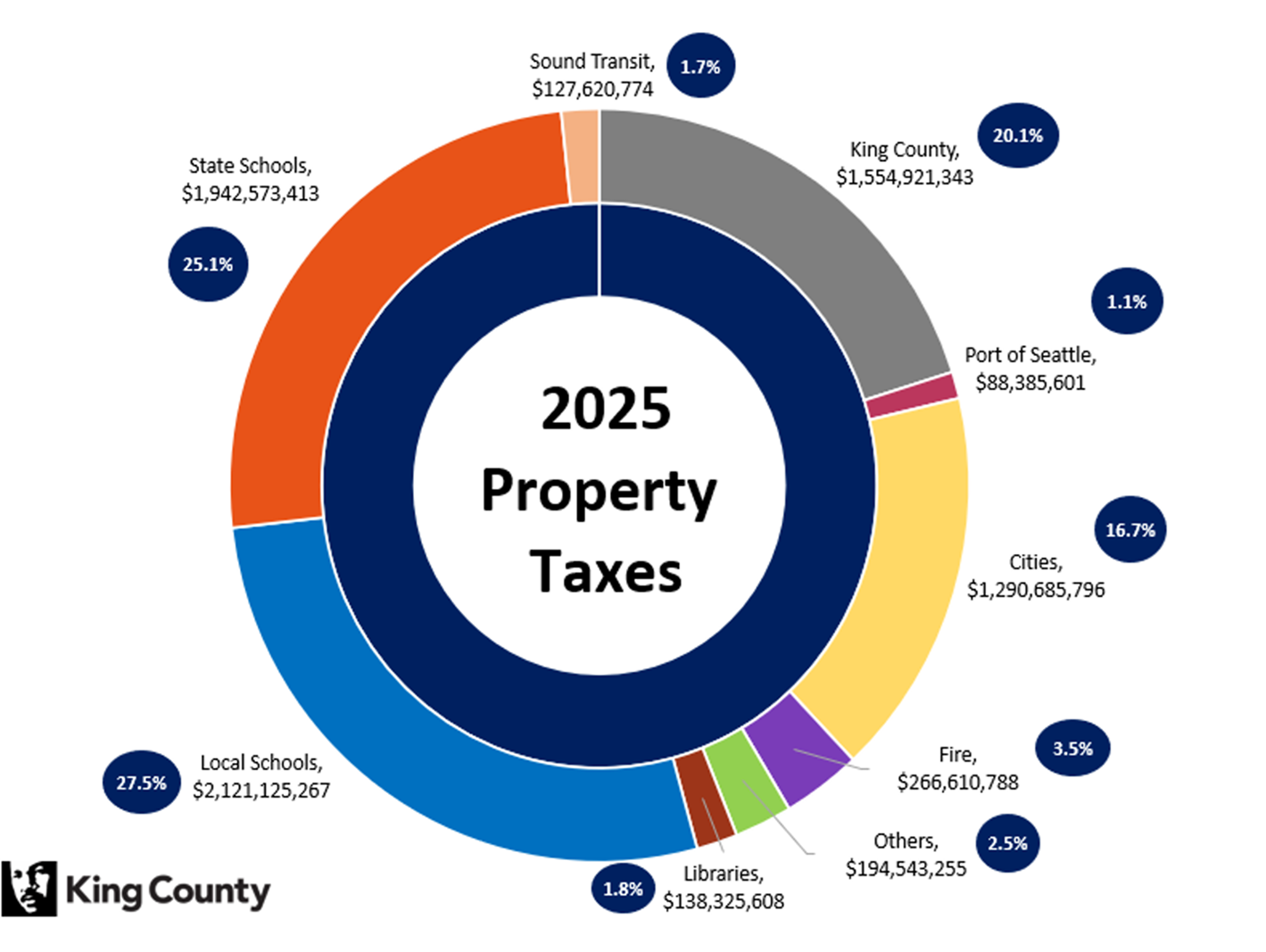

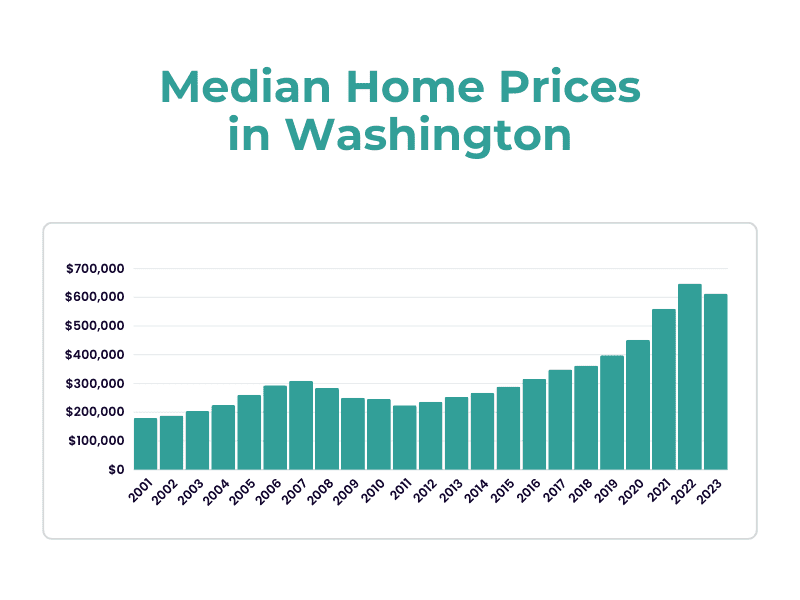

If you’ve opened your latest property tax statement and felt your stomach drop, you’re not alone. As we covered in our recent blog on rising property taxes, homeowners across King and Snohomish Counties are seeing sharp increases in their assessments.

But here’s the good news: there are steps you can take to reduce your tax burden. Whether it’s applying for an exemption or challenging your assessed value, this guide breaks down your options and the key things to watch out for.

Property taxes in Washington State are typically due in two installments:

This schedule applies to both King County and Snohomish County. If taxes are not paid by the due dates, interest and penalties begin to accrue. Even if you’re planning to appeal or apply for an exemption, it’s smart to pay on time to avoid unnecessary charges.

Feeling the squeeze from your last tax bill and worried about the next one? Contact Georgia Buys today to explore simple, stress-free solutions.

King County offers a Property Tax Exemption Program for seniors, people with disabilities, and disabled veterans. You may qualify if:

This exemption can freeze the value of your home for tax purposes and reduce or eliminate certain levies.

Please note that this information is accurate as of June 27, 2025. Please refer to King County’s program directly for up-to-date or additional information.

Snohomish County provides a Senior Citizen and Disabled Persons Exemption Program for:

To qualify, your gross household income must be $55,000 or less, and the home must be your primary residence. Depending on your income level, you could see a partial or full exemption on $60,000 to $70,000 of your property’s assessed value.

Please note that this information is accurate as of June 27, 2025. Please refer to Snohomish County’s program directly for up-to-date or additional information.

If your assessed value seems too high, you can file an appeal through your county’s Board of Equalization (BOE). Here’s how:

A successful appeal can result in a lower assessed value and tax bill for the current year. In some cases, it may influence values for subsequent years as well.

The most direct benefit is a lower annual property tax bill.

For homeowners on fixed incomes or dealing with rising living expenses, a successful appeal can provide much-needed relief. It can also correct overestimations caused by inaccurate assumptions about your home’s condition, size, or comparable sales.

While a lower tax bill is appealing, there are some drawbacks to consider:

Think about your long-term goals before pursuing an appeal. A tax break now may affect the financial picture down the road.

Falling behind on your property tax bill is more common than you might think, especially in areas where assessments have skyrocketed.

If taxes are not paid:

To prevent this from happening, homeowners should contact the Snohomish County Treasurer or King County Treasury Operations to ask about payment plans or tax deferral options. If the burden becomes too great, selling the property may help preserve your equity and credit.

Struggling to keep up with property taxes? Let’s talk about how we can help you move forward with less stress and more financial breathing room.

Yes. At Georgia Buys, we work with homeowners throughout King and Snohomish Counties who feel overwhelmed by property taxes or unfair assessments.

Whether you want to explore your appeal options, connect with the right county office, or sell your home as-is without the cost and stress of traditional listings, we’re here to help.

We make cash offers with no fees, no repairs, and no commissions, so you can move on comfortably and quickly.

Request your free offer here!

Rising property taxes are putting pressure on families, seniors, and long-time homeowners throughout the region. But there are tools available to reduce the burden, protect your finances, and preserve the value of your home.

Whether you’re applying for an exemption, considering an appeal, or ready to move on from your property, Georgia Buys is here to help you understand your options and take action.