If you’re behind on your mortgage payments, you might be feeling scared, overwhelmed, or even stuck. The word “foreclosure” can sound like the end of the road. But it doesn’t have to be. At Georgia Buys, we’ve worked with homeowners who felt like they were out of options, and we’ve helped them find a better path forward.

A few months back, we got a call from Phil when he learned that his home had gone into pre-foreclosure. His lender was constantly calling and asking when they would receive the missed payments and penalty fees. Phil understood he had less than 20 days to make a portion of the overdue payments, otherwise the bank would move his property into full foreclosure. He also shared with our Home Buying Specialist, James, that his income was no longer what it had been when he first bought the home years ago. On top of that, costs like utilities, property taxes, and everyday expenses had gone up so much in recent years that keeping up with his mortgage had become impossible.

Phil shared that his current situation no longer suited him. James listened carefully and wanted to help. Our team quickly set up a time to tour his property, meet with him in person, and find out exactly what he needed in an offer to get out of this mess. We also determined how long he would need to sort through his belongings and set a plan to use some of our local resources to help find and move into his new home. We presented an offer that was as high as we could realistically make with the best terms possible, and Phil was happy to accept. He was able to save his credit, move to another neighborhood in Seattle, and settle into a rental property that fit his budget and lifestyle. We felt lucky to have been there for Phil and to help him protect his future.

In this blog, we’ll talk about how a cash buyer like Georgia Buys can help you avoid foreclosure, protect your credit, and keep as much of your equity as possible. We’ll also explain what foreclosure really means, how the timeline works, and why acting fast can make a big difference in the outcome.

Let’s start with the basics.

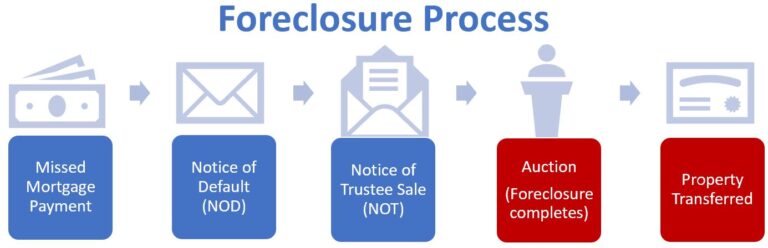

Pre-foreclosure means you’ve missed some mortgage payments, and your lender has sent you a warning notice. It’s serious, but you still have time to fix things. You can pay what you owe, set up a new plan with your lender, or sell your home before it gets taken from you by the bank.

Foreclosure is the next step. If too much time passes and nothing is done, the bank can take your home and sell it at auction or simply retain it as their Real Estate Owned property (REO). Once foreclosure begins, the legal process is in motion. This dramatically damages your credit and can make it extremely difficult to buy another home later. It can even affect your ability to rent, get a loan, or secure a job that requires credit checks.

The good news? Until the actual sale date, you still have options.

Even when it feels overwhelming, it’s important to take action sooner rather than later. The longer you wait, the harder it becomes to fix the situation. Missed payments grow into a bigger balance, and fees start piling up fast. Legal costs, penalties, and interest can snowball quickly. The further along you are in the foreclosure timeline, the fewer options you will have.

If the house goes into foreclosure and sells at auction (or is retained by the lender), you lose the chance to sell it yourself and may walk away with nothing. Plus, the impact on your credit score can be devastating and long-lasting.

That’s why it’s so important to take action as soon as you know you’re falling behind. Even if you don’t have the money to catch up right away, there are still things you can do, and people who can help.

Worried about missed payments turning into foreclosure? Let Georgia Buys show you what your home could be worth right now.

Selling to a cash buyer might not be something you’ve thought about, but it can make a huge difference. Here’s how:

In many cases, selling to a cash buyer can actually stop the foreclosure process, especially if you’re still in pre-foreclosure and can act quickly. Getting a cash offer that will satisfy your full outstanding mortgage is more difficult the longer you wait and the higher the bills climb.

You do have other options, like asking your bank for help, applying for a loan modification, or doing a short sale. But these options often take time, require approval, and aren’t guaranteed to work out.

Loan modifications can be helpful if you qualify, but they often come with paperwork, delays, and uncertainty. A short sale requires the bank’s approval and can take months and may lead to additional tax implications. During the time these options can take, foreclosure can still happen if the process stalls or fails.

Selling to a cash buyer can be a good fit if you:

Not all cash buyers are the same. Here’s what to watch for:

At Georgia Buys, we’re proud to be a local Seattle-based team that listens, helps, and aims to create the right solution for each homeowner. We treat every seller with respect and offer honest guidance, even if that means helping you explore other options.

Ready to talk about your options? Contact Georgia Buys today and see how we can help.

If you’re facing foreclosure, you’re not alone. Many families in Washington have gone through this. According SoFi, one in roughly every 10,000 Washington homes will foreclose. But just because you’re in a tough spot doesn’t mean you have to stay there.

Talking to a cash buyer might give you the breathing room you need to move forward. Whether you choose to sell or just want to understand your options, we’re here to help.

Want to see what a cash offer could look like for your Seattle-area home? Reach out to Georgia Buys today, we’ll walk you through every step.

Editor’s note: This article is for educational purposes only, not financial, tax, or legal advice. Georgia Buys always encourages you to reach out to an advisor regarding your individual situation.