The Seattle housing market is always a-shifting. Whether you’ve owned your home for decades or just a few years, understanding current trends is key to knowing when (and how) to make your next move.

Below, I’ve answered the most common questions Seattle homeowners are asking in 2025 about selling their homes, buying new real estate, the rental market, and everything in between. I hope I can answer something you’ve been wondering. Still have questions at the end of this blog? Call us today and we’ll find the answers for you!

As of June 2025, the median home price in Seattle is approximately $930,000, according to Redfin. This represents a steep 9.4% climb year-over-year, following a more volatile period in 2022 and 2023.

Neighborhoods like Queen Anne, Green Lake, and parts of Ballard are continuing to see strong buyer interest, especially when the homes are updated and move-in ready. Even with mortgage rates higher than recent years, demand has remained solid, largely driven by millennial buyers and relocators.

If your home has desirable features like modern updates, a home office, or ADU potential, now may be an opportune time to sell.

Knowing your home’s value is the first step in deciding whether it’s the right time to sell. Fortunately, there are a few simple ways to get a ballpark estimate, right from your couch.

Start by checking sites like Redfin and Zillow to browse comparable properties (or “comps”) in your neighborhood. Look for:

of thousands of dollars, based on outdated data or lack of context.

If you want a more accurate, personalized valuation, you can request a completely free, no-pressure estimate from our team at Georgia Buys. We’ll consider the unique features of your home, local trends, and recent off-market sales you won’t find online. No strings attached—just real numbers and honest feedback.

Curious what a home like yours is worth in today’s housing market? Reach out to Georgia Buys and we can give you an idea of what you might be able to net in an on or off-market sale.

In mid-2025, homes in Seattle are averaging 11 days on the market, up from just 9 days this time last year. While that might sound like a slowdown, it’s still relatively brisk compared to national averages.

Homes that are well-priced and professionally presented, think clean curb appeal, modern staging, and clear disclosures, often sell even faster, sometimes within the first week.

Buyers, however, are less likely to waive contingencies in today’s higher-interest environment, which makes prepping your home before listing more important than ever for a quick sale. A pre-listing inspection and making repairs can make a major difference in both time on market and offer strength.

According to a November 2024 report, the median age of first-time homebuyers is about 38, with many working in tech, healthcare, and other stable industries. These millennial buyers tend to be highly informed and value move-in-ready homes in walkable neighborhoods.

If your home offers bonus office space, good schools nearby, or modern upgrades, it could be especially attractive to this group.

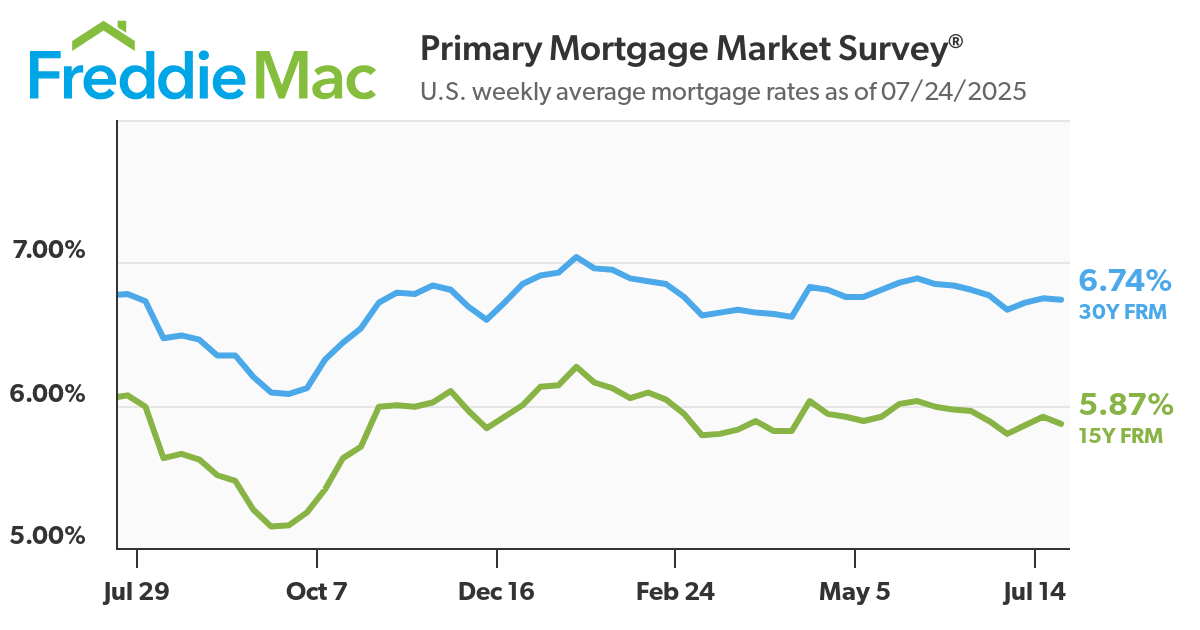

Yes, mortgage rates in Seattle are currently hovering between 6.6% and 7% on a 30-year loan, as reported by Freddie Mac, but they’ve also leveled off in recent months. That’s a far cry from the sub‑4% rates we saw just a few years ago, and it has changed the way buyers approach the market.

Throughout much of 2024, many buyers were holding out in hopes that rates would drop back down. But over the past several months, buyers have begun to reconcile with the reality that higher rates are likely here for a while. Even so, there’s still some hesitation, many are weighing affordability carefully and taking extra time to make offers.

For sellers, this doesn’t mean the market has stalled. Well‑priced, move‑in‑ready homes in desirable neighborhoods are still drawing plenty of attention. It does mean that strategy matters more than ever, buyers are less likely to waive contingencies and more sensitive to overpricing.

And while it’s wise to avoid overreacting to headlines, all homeowners should keep an eye on decisions from the Federal Reserve, since those shifts can influence mortgage rates over time. Understanding these dynamics and working with an agent who stays on top of them, can give you a major edge when listing your home.

While renting may seem like a simpler option after selling, it’s not always the most cost-effective long-term. A 2-bedroom apartment in Seattle rents for around $2,800/month, per Apartments.com.

Meanwhile, owning a $700,000 home with a 6.8% interest mortgage means you’ll pay around $5,000/month, but you’ll be building equity. For many, owning still beats renting over time if your finances are in order.

If you’re debating a move, consider your goals. Want to travel, reduce responsibilities, or simplify life? Renting might be right. But if you’re planning to stay local and can afford a comfortable mortgage, buying again could set you up for future wealth.

“House poor” means putting so much of your income toward your home that you can’t comfortably afford anything else. That’s never the goal.

Experts at NerdWallet recommend keeping your monthly housing costs below 30% of your gross income. Here’s a quick breakdown:

Also factor in:

If you’re selling and planning to buy again, talk to a trusted lender and agent early to ensure you’re moving into a financially sustainable home.

If your home is in good condition, located in a high-demand neighborhood, and you’re sitting on equity, now may be the right time. Buyers are still active, and inventory remains lower than pre-pandemic levels.

Just keep in mind: the longer you wait, the more interest rates and market dynamics could change. It’s always smart to get a free home valuation and explore your options, whether on-market or off-market.

Tired of sitting on the sidelines waiting for the market to sweeten? Reach out to Georgia Buys today and see what the upside of selling may be.

A great agent can make the difference between a smooth, profitable sale and a stressful experience. When you’re ready to interview agents, start by looking in places where the most active and experienced professionals are already working.

Visit open houses in your neighborhood to see agents in action, explore agent directories on platforms like Zillow to read reviews, and browse company websites such as Keller Williams or Windermere to find top performers in your area.

When comparing agents, ask questions like:

And if you’d like a recommendation, we’d be happy to help. Over the years we’ve worked with many fantastic agents to sell our own projects. Our go‑to team is Urban Real Estate Partners, who we’ve seen consistently deliver exceptional service and results.

Just like with agents, not all lenders are created equal. Look for:

If you’re selling and buying, getting pre-approved for your next home early will help you act quickly when the right opportunity comes along. Most lenders offer free consultations, so take advantage of that and compare at least 2–3 options.

Navigating Seattle’s market in 2025 doesn’t have to be overwhelming. With the right info and the right people around you, it can be a smooth, strategic next chapter; whether you’re upsizing, downsizing, or simply curious.

Got questions about your home? I’d be happy to chat, run the numbers, or connect you with a trusted lender. This isn’t about pressure, it’s about preparation.